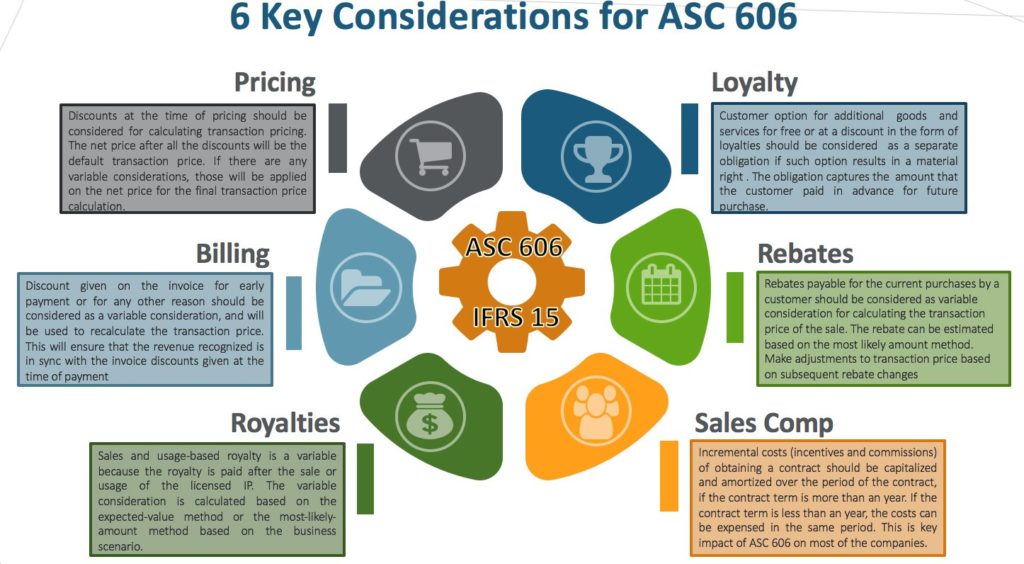

ASC606 has many provisions for revenue recognition, but here are the 6 key considerations that will impact the majority of the companies implementing the standard. The considerations are pricing, loyalty, rebates, sales compensation, royalties, and billing. Organizations should check their current revenue recognition practices around these items and understand how it will change with the new standard. Ayara can help to recognize revenue covering these six considerations and ensure compliance with ASC606.

Pricing is one of the key considerations for revenue recognition under ASC606. Companies offer a variety of discounts in the form of volume discounts based on the usage, discounts for bundles in the form of Multi-element arrangement (MEA), and discounts at the time of renewal. These discounts will impact transaction price calculation. The net price of the transaction after all the discounts is the default transaction price. Any variable considerations will be applied to this price to calculate the final transaction price.

Loyalty points are the customer option for additional goods and services for free or at a discount price in the future. If loyalty points result in a material right, then it should be considered as a separate performance obligation. Customer pays in advance for the option and can use it to buy goods and services. The obligation tracks the amount based on the loyalty points earned by the customer. When the customer redeems loyalty points to buy goods and services, then the appropriate revenue is recognized for the obligation.

Companies offer rebates to drive the buying behavior of their customers. This will enable customers to buy more goods and services, because the more goods they buy, the higher the rebate they will earn. Rebates processed for customers are considered as variable consideration and will be used to calculate transaction price for the sale. ASC606 requires that companies estimate rebate for every transaction and recognize the revenue. The transaction price can be adjusted based on the actual rebate processed, or for any changes in the rebate.

Sales compensation is the critical component that impacts more than 90% of the organizations implementing the standard. Sales compensation consists of incentives and commission paid to salespeople. These costs are the incremental costs incurred in obtaining a contract. The cost should be capitalized and amortized over the period of the contract if the contract duration is more than one year. The cost can be expensed if the contract duration is less than a year. This is a big change in the standard as the cost capitalization is optional in the current standard (ASC605).

Sales and usage-based royalty are a variable consideration because the royalty is paid after the sale or usage of the licensed IP. The variable consideration is calculated based on the expected-value method or the most-likely-amount method based on the business scenario. There can be scenarios where the contract is negotiated for the minimum guarantee amount. In this case, the minimum guarantee amount can be recognized first, and then any additional revenue for royalties received based on the sales.

Discount given on the invoice for early payment or for any other reason should be considered as variable consideration and will be used to recalculate the transaction price. This will ensure that the revenue recognized is in sync with the invoice discounts given at the time of payment. The practical expedient provision in the standard will enable customers to recognize revenue based on the invoiced amounts in some scenarios. The future articles in the series will discuss each of the six considerations, and how Ayara can help implement the standard and expedite the process.