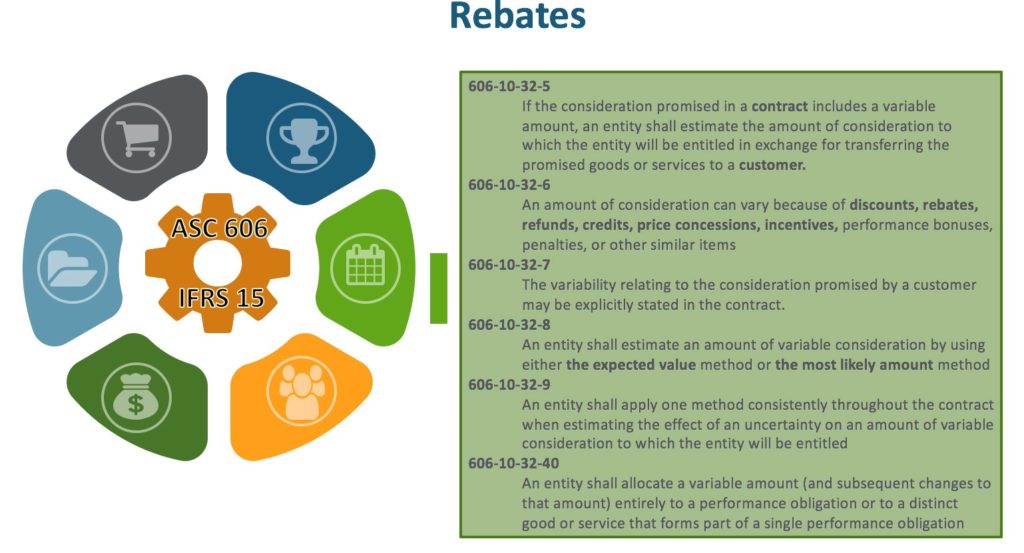

Rebates are the incentives given to customers to buy or consume more goods and services that will meet the rebate criteria and earn the rebate amount. Typically rebates are offered in multiple tiers with higher tiers offering larger rebate amounts which will encourage customers to buy more goods and services. Because rebates are a future consideration promised to customers they are treated as variable consideration in ASC 606. The following are the provisions in the standard that give guidance about rebates considered as variable consideration.

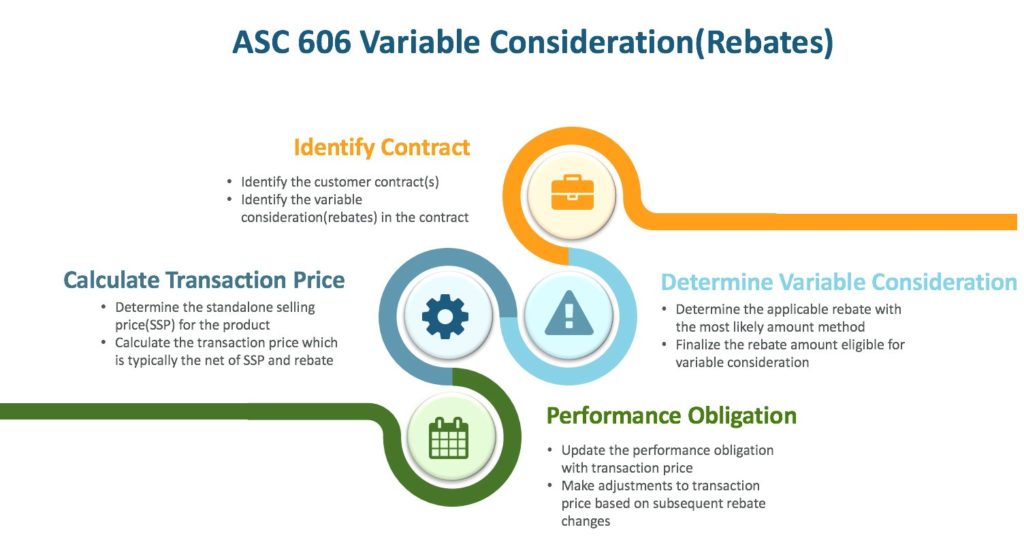

When quoting for a product/service that is eligible for a rebate, the rebate tiers are mentioned for the product/service. These tiers can vary by the customer or for each quote. The new standard requires that the variable consideration for rebates be stated in the revenue contract explicitly. It is important to identify the contract and the rebate amount for each sale. “The expected value method” and “the most likely amount” are the two methods of estimating the rebate amount. “The most likely amount” is the preferred method used by many companies.

In “the most likely amount” method, the rebate amount is determined by a rebate tier in which the customer is most likely to meet the criteria. Based on the tier the estimated rebate amount is calculated and is treated as the variable consideration for the sale. The estimated rebate amount and the standalone selling price of the product/service are used to calculate the transaction price that will drive the revenue stream. Since the calculation is based on the estimated rebate, an adjustment is required for the revenue after the final rebate calculation.

The actual sale or consumption of a product/service is tracked by the customer orders that will give the quantity sold during a rebate period, which is typically a month or a quarter. At the end of the period, the rebates are processed for the sold quantity that will determine the rebate tier for the actual rebate amount. If the actual rebate amount is less than the estimated rebate amount, then the difference between the estimated and actual amounts is recognized as additional revenue. If the actual rebate is more than the estimated amount then the recognized revenue is adjusted accordingly.

Estimating rebate amount at the time of sale and subsequent adjustments based on the actual rebate amount can be challenging. Ayara can simplify the process and streamline revenue recognition for ASC 606. This will enable businesses to have a view of estimated rebates, revenue adjustments, and recognized revenue for each period by product, by a legal entity, and any other criteria.