Forecasting accurate revenue is a key capability that companies want from their QTC investment. In majority implementations of QTC, customers forecast revenue from opportunities in pipeline and order bookings. But these forecast numbers are not accurate as the revenue numbers can change before opportunities are converted into bookings, and bookings may not reflect the right revenue allocation and variable considerations. Since the revenue forecast is important for companies to make strategic decisions and give proper guidance to markets, there should be a reliable method to forecast accurate revenue.

Companies need accurate revenue numbers at an early stage in the QTC process. Typically they need the data at least at the time of creating a quote. This will not only give them early visibility to revenue forecasts but also address a key pain point where a salesperson will book a deal at a lower margin (sometimes negative margin) without approval from the finance team. With revenue visibility at the time of quoting, margin can be calculated and appropriate action can be triggered for approval before finalizing the quote.

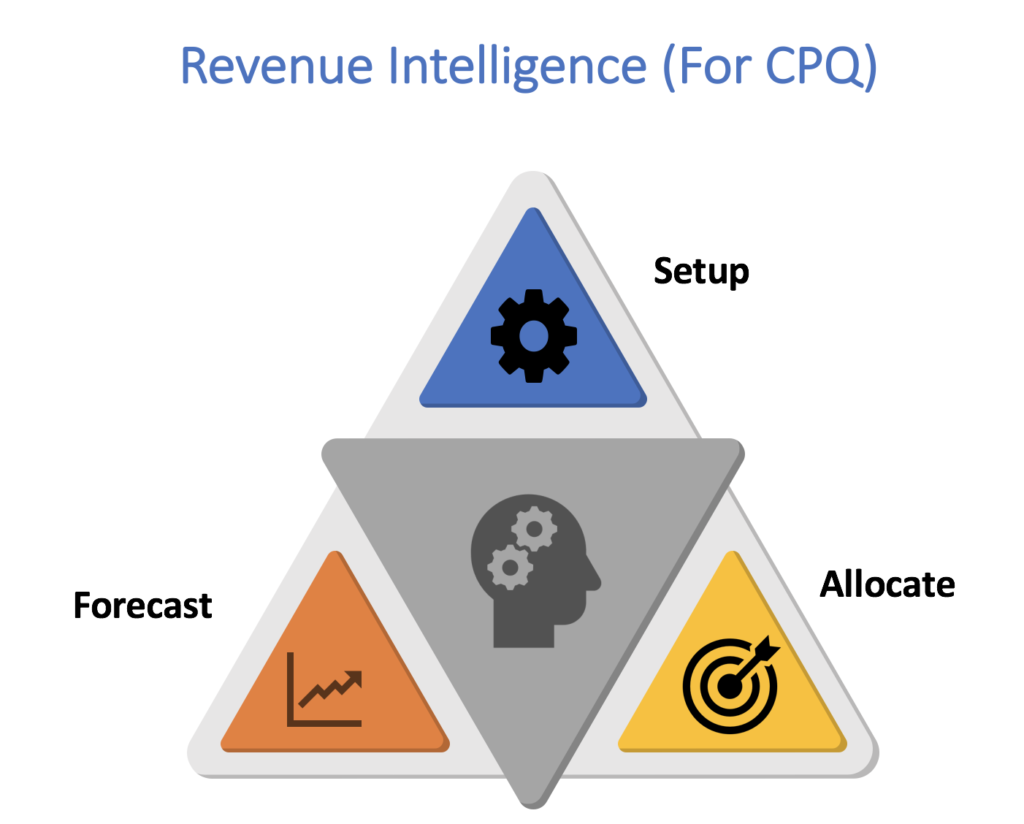

There are three components of revenue intelligence for CPQ. The setup required to calculate revenue and display on the quote. Allocate the revenue based on predefined rules, and finally generating the forecast. The allocation and forecast will be processed when creating a quote and presented to the user before finalizing it. The allocations and forecast will be regenerated every time a change is made to pricing or the attributes of a quote are changed. This will ensure that the revenue forecast is in sync with the latest changes in the quote.

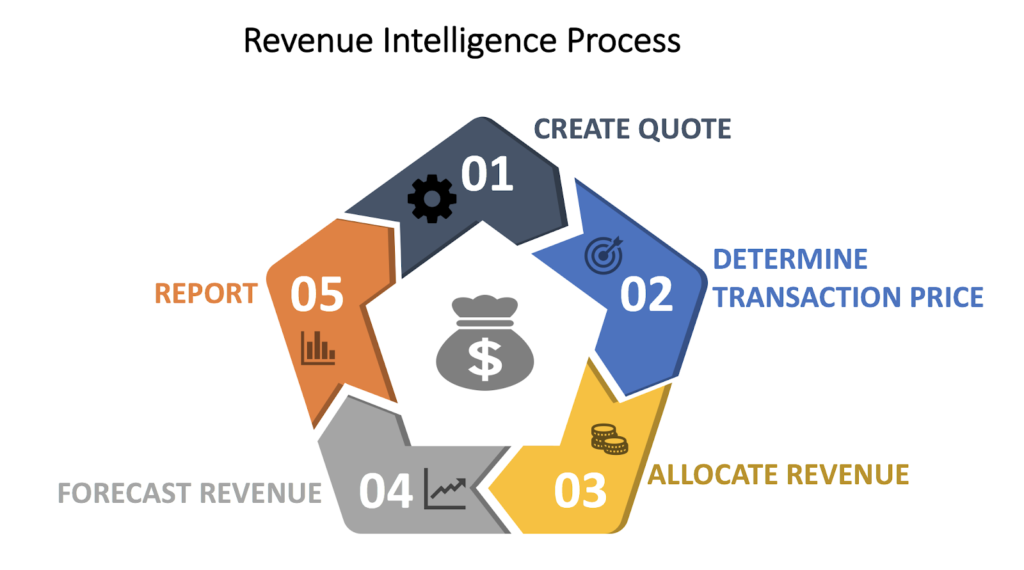

The process is triggered with quote creation in CPQ which will determine the transaction price (net price minus variable consideration). The transaction price is used as the basis for revenue allocation based on preconfigured rules or formulas. The CPQ system can now determine the actual margin (revenue allocation minus cost) for the deal. The calculated margin can trigger a workflow for approval if it’s below a threshold level. The revenue is forecasted for the duration of the deal to show the revenue spread for each period and can be reported for further analysis.

Revenue intelligence will give control to users over the margins they want on each deal and will give an accurate revenue forecast at an early stage in the QTC process. This will help the management team to make strategic decisions and give reliable guidance to the stock market and shareholders. Ayara provides revenue intelligence functionality that will integrate to any CPQ (Salesforce, Apttus) system, and gives the revenue forecast visibility on the quotes. It will update the forecast based on the quote changes and ensure that the forecast is correct and recognized revenue is accurate.